tax avoidance vs tax evasion examples

Difference Between Tax Evasion and Tax Avoidance. Get the detail with more examples in this article.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Depending on where a persons tax evasion crime lands in the set categories they may face a.

. Tax avoidance means legally reducing your. Tax Evasion vs. Tax evasion is the use of illegal means to avoid paying your taxes.

Updated on Friday October 23 2020. Tax avoidance is when an individual or company legally exploits the tax system to reduce tax liabilities such as establishing an offshore company in a tax haven. Call 247 713-775-3050.

As a result you need not cheat and get yourself into trouble. Classify the tactics below as examples of Tax Avoidance or Tax Evasion by clicking on the. Is tax avoidance legal or illegal.

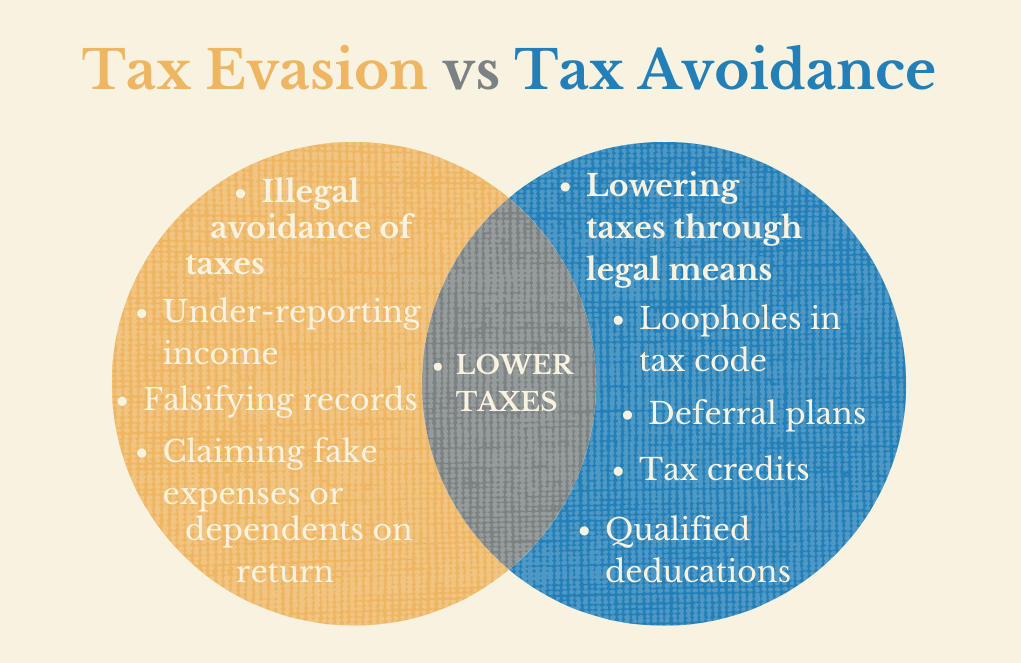

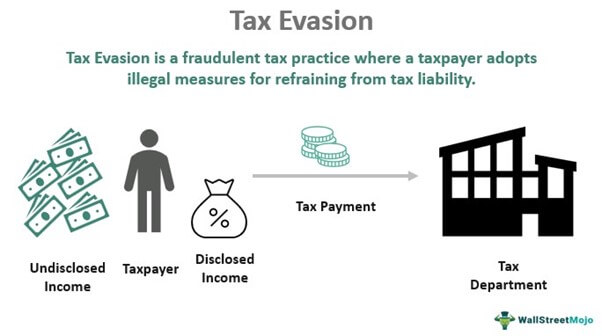

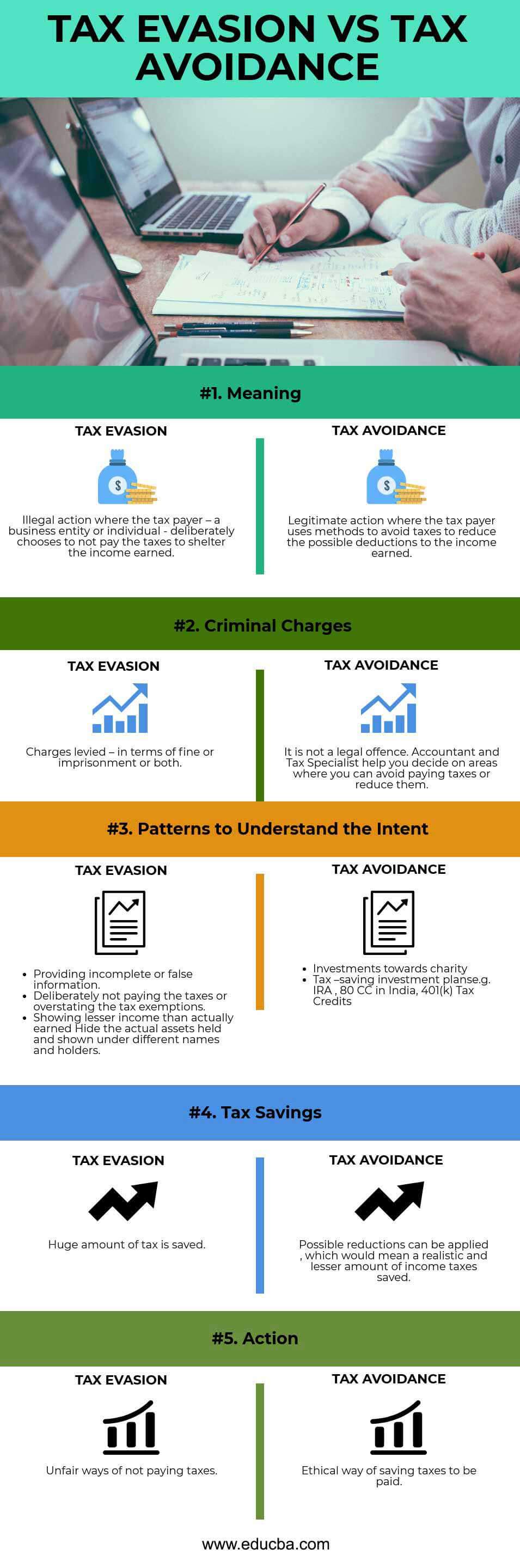

Simply put it means. Tax avoidance is different from tax evasion. Tax Evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts.

Tax Evasion vs Tax Avoidance. Worksheet Solutions The Difference Between Tax Avoidance and Tax Evasion Theme 1. When it comes to taxes and the IRS sometimes there is a fine-line between planning to minimize taxes aka legal Tax.

The difference between tax avoidance and tax evasion boils down to the element of concealing. Are you unsure of the difference in tax avoidance vs. There are a series of legitimate ways approved by the IRS to lower your tax bills.

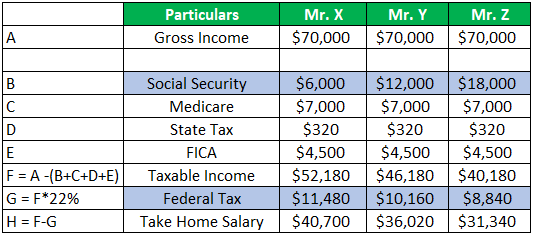

Let us consider the following tax avoidance examples to understand the concept and the process better. The first one is the evasion of assessment which includes not informing tax authorities of your exact income. A taxpayer charged with tax evasion could be convicted of a felony and be.

Fined up to 100000 or 500000 for a corporation. It is a legal strategy that. Unlike tax evasion which relies on illegal methods tax avoidance is a legal method of reducing taxable income or tax owed by an individual or business.

Tax evasion means concealing income or information from tax authorities and its illegal. Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is. Tax evasion includes underreporting income not.

Tax evasion occurs when the taxpayer either evades assessment or evades payment. For example deductions for mortgage interest are meant to incentivize homeownership and deductions for charitable contributions are designed to incentivize giving. Tax Avoidance vs Tax Evasion.

While both tax avoidance and tax evasion may sound like something that could get you in trouble with the IRS tax avoidance is legal. There are prison sentences and hefty fines. Tax evasion can lead to a federal charge fines or jail time.

If income is not reported by someone authorities do not. It is rare that any company actually contributes the highest rate due to tax avoidance strategies that bring down the companys overall effective tax rate. Tax evasion is a federal offense.

In tax avoidance you structure your affairs to. Your Role as a Taxpayer Lesson 3. Tax Avoidance vs.

The Taxpayers Responsibilities Key Terms tax avoidanceAn action. According to the IRS tax avoidance is an action you can take to reduce your tax liability and therefore increase your after-tax income. Tax avoidance is perfectly legal and encouraged by the IRS but tax evasion is against the law.

Let us discuss some of the major differences between Tax Evasion vs Tax Avoidance. To start with tax avoidance is legal while tax evasion is illegal. Imprisoned for up to five years.

Tax Evasion vs.

The Concept Of Tax Evasion And Tax Avoidance Definition And Differences

The Concept Of Tax Evasion And Tax Avoidance Definition And Differences

Tax Avoidance Meaning Methods Examples Pros Cons

Tax Evasion Vs Tax Avoidance Dsj Cpa

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

What If A Small Business Does Not Pay Taxes

Tax Evasion Vs Tax Avoidance What Are The Legal Risks

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Fraud Vs Tax Evasion Vs Tax Avoidance

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

The Sources And Size Of Tax Evasion In The United States Equitable Growth

Tax Avoidance Vs Tax Evasion Expat Us Tax

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion Meaning Types Examples Penalties

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Tax Avoidance Definition Comparison For Kids

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics