south carolina inheritance tax 2019

It is one of the 38 states that does not have either inheritance or estate tax. If they are married the spouse may be able to leave everything to each other without paying any estate tax.

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

South Carolina Personal Income Tax.

. Our number is 888-748-KING 5464. As well as how to collect life insurance pay on death accounts and survivors benefits and fast South Carolina probate for small estates. Creating a will is oftentimes the first step that South Carolina residents must take in estate planning.

This means that if you have 3000000 when you die you will get taxed on the 300000 over the 2700000 exemption. As of 2019 if a person who dies. 117 million increasing to 1206 million for deaths that occur in 2022.

We invite you to come in and talk with one of our attorneys in-person during a consultation. In addition to the federal estate tax of 40 percent some states levy an additional estate or inheritance tax. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000.

Does South Carolina Have an Inheritance Tax or Estate Tax. Iowa has a separate inheritance tax on transfers to others than lineal ascendants and descendants. Federal Estate Tax.

Every state has its own unique set of laws that go into inheriting estates and south carolina is no exception. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. No estate tax or inheritance tax.

In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. Writer must be of sound mind and body. Washington States 20 percent rate is the highest estate.

7 00 8 TAX on Active Trade or Business Income attach I-335. Info about South Carolina probate courts South Carolina estate taxes South Carolina death tax. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes.

In addition gifts to spouses who are not US. South Carolina has no estate tax for decedents dying on or after January 1 2005. No estate tax or inheritance tax.

There are no inheritance or estate taxes in South Carolina. No estate tax or inheritance tax. Easily Download Print Forms From.

Even though there is no South Carolina estate tax the federal estate tax might still apply to you. The requirements for a valid will change from state to state but are pretty straightforward in South Carolina. 7 TAX on Lump Sum Distribution attach SC4972.

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. 8 00 9 TAX on excess withdrawals from Catastrophe Savings Accounts.

The South Carolina Department of Revenues Government Services Division has issued a Decision giving South Carolina counties guidance regarding the 2019 tax sale in the. These state income taxes are paid in addition to federal income taxes. Governor Henry McMaster recently signed a bill allowing for the creation of a statewide filing and indexing system of liens imposed by the South Carolina Department of Revenue that will take effect on July 1 2019.

South Carolina Inheritance Law. October 16 2019. A married couple is exempt from paying estate taxes if they do not have children.

The top estate tax rate is 16 percent exemption threshold. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. No estate tax or inheritance tax.

Ad Inheritance Tax 2019. Blank Forms Pdf Forms Printable Forms Fillable Forms. The lawyers at King Law can help you plan for what happens after youre gone and were here to help you get a better sense of where you stand.

Note that if you leave everything to your spouse there is no estate. 9 00 10Add line 6 through line 9 and enter the total here. States Without Death Taxes.

Currently South Carolina does not impose an estate tax but other states do. Minnesota has an estate tax for any assets owned over 2700000 in 2019. A federal estate tax is in effect as of 2021 but the exemption is significant.

Writer must be at least 18 years. It has a progressive scale of up to 40. 2019 the New York estate tax exemption amount will be the same as the federal estate tax applicable exclusion amount prior to the 2017 Tax Act which is.

However the Palmetto States income tax is between 0. November 2019 3 october 2019 2 september 2019 3 august 2019 4 july 2019 2 Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. Tax was permanently repealed in 2014 with repeal of all of.

The rates of tax in Minnesota on amounts over 2700000 are between 13 16. No estate tax or inheritance tax. South Carolina charges a progressive income tax on its residents ranging from 0 at the lowest bracket to 7 at the highest bracket.

The federal estate tax is levied on a propertys taxable part before the heir transfers the assets. This is your TOTAL SOUTH CAROLINA TAX10 00 30752190 Page 2 of 3 Your SSN _____ 2019. Will must be signed by the writer and two.

However according to some inheritance laws of South Carolina not all the deceased persons property may be considered as a part of the estate. Monday August 30 2021. The federal estate tax exemption is 117 million in 2021.

That way a joint bank account will automatically pass. This tax is portable for married couples meaning that if the right legal steps are taken a married couples estate of up to 234 million is exempt from the federal estate tax when both. Annual 2019 Tax Burden 75000yr income.

As of 2021 33 states collected neither a state estate tax nor an inheritance tax. Maryland is the only state to impose both. 4 The federal government does not impose an inheritance tax.

The Pros And Cons Of Retiring In South Carolina

2022 Best Places To Live In South Carolina Niche

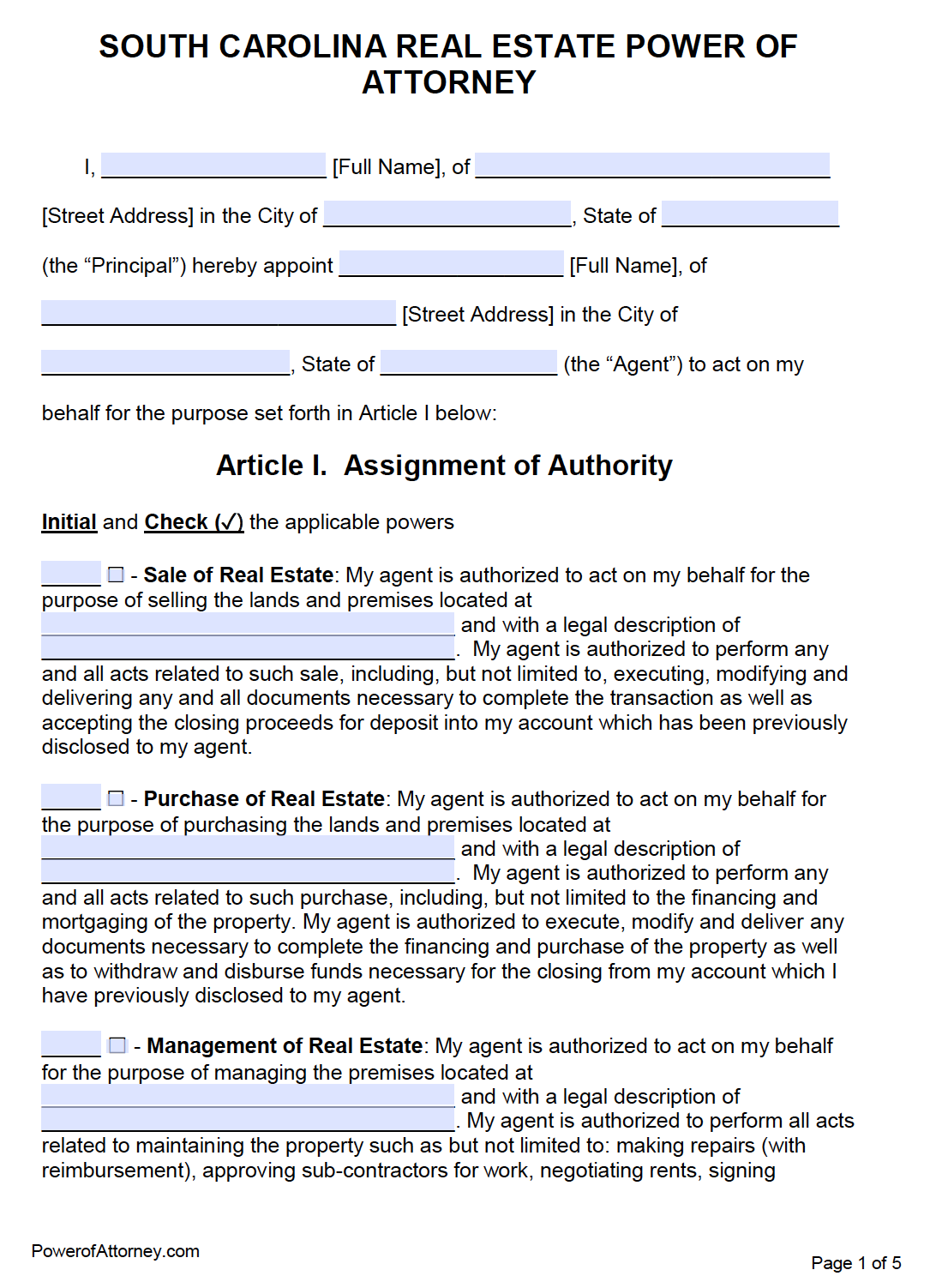

Free Durable Power Of Attorney South Carolina Form Pdf

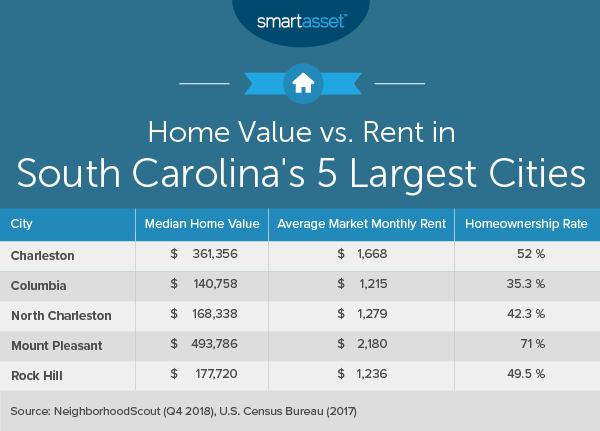

Cost Of Living In South Carolina Smartasset

How To Become A South Carolina Resident

The True Cost Of Living In South Carolina

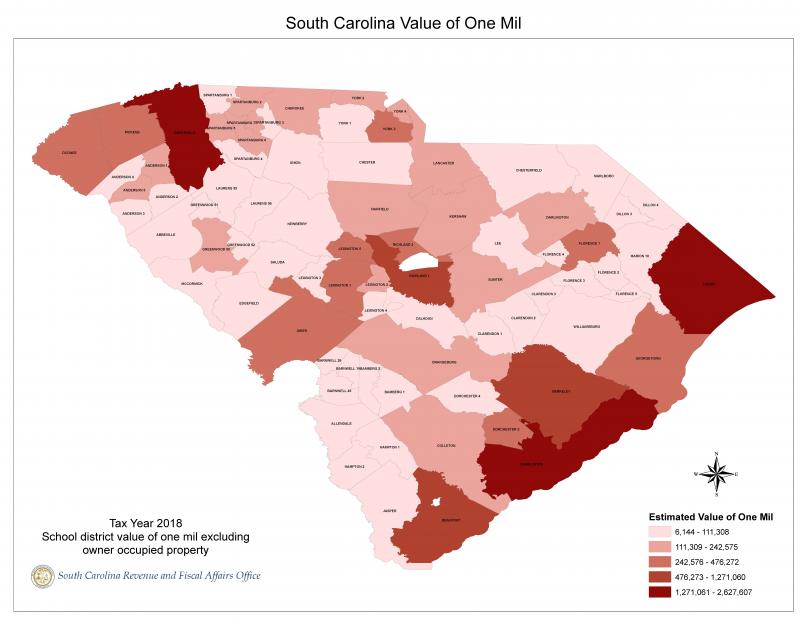

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

See How South Carolina S Counties Are Growing And Shrinking Gem Mcdowell Law 843 284 1021 Estate Business Law Local

South Carolina Israel Cooperation

Free Real Estate Power Of Attorney South Carolina Form Pdf Word

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina And The 19th Amendment U S National Park Service